About this programme

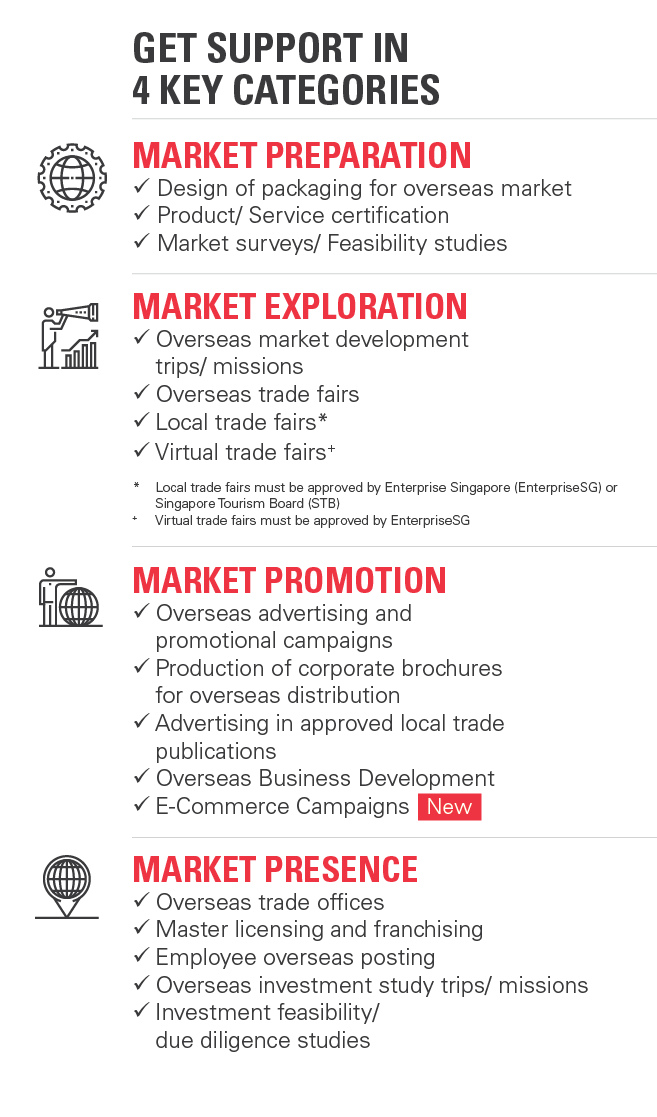

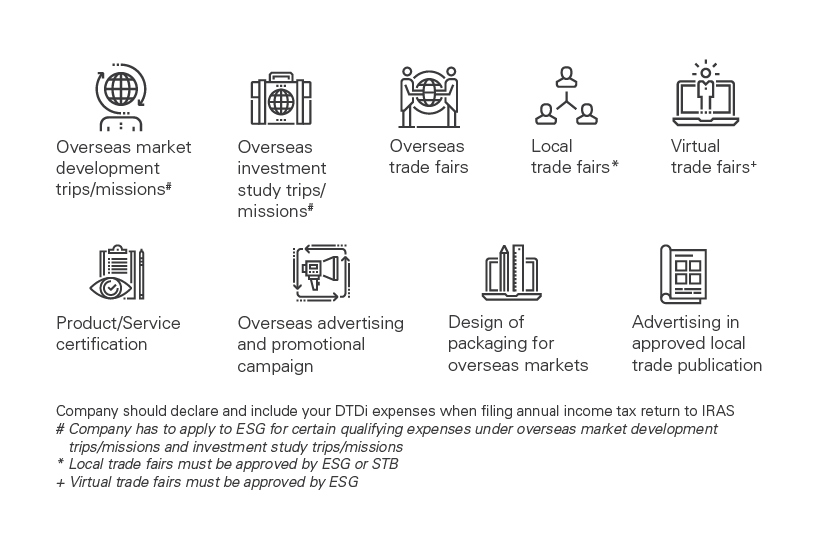

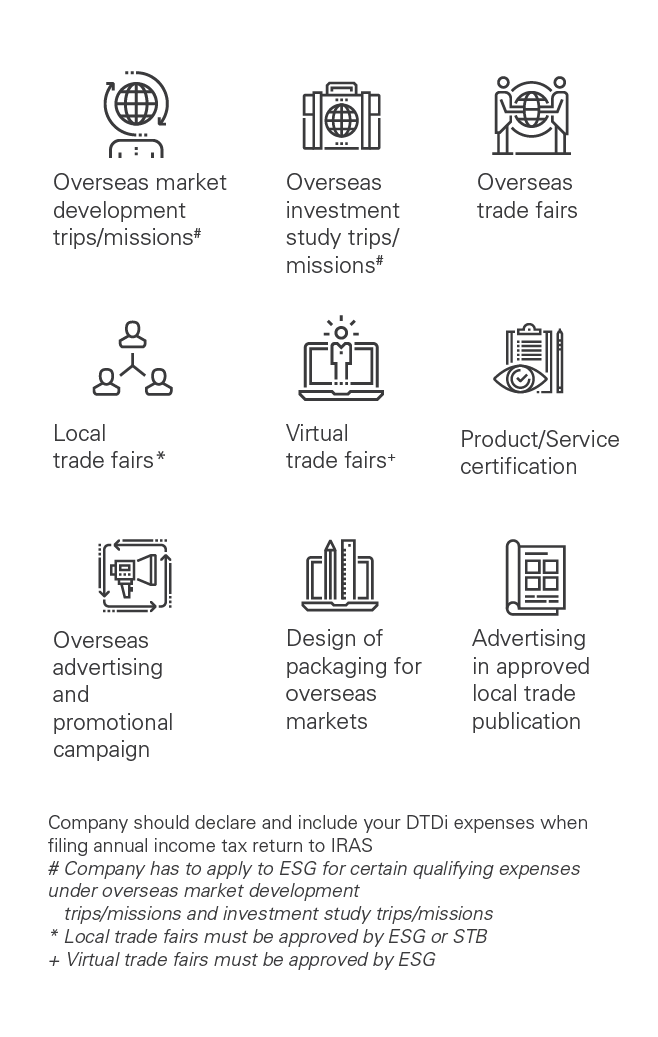

Companies planning to expand overseas can benefit from the Double Tax Deduction Scheme for Internationalisation (DTDi), with a 200% tax deduction on eligible expenses for international market expansion and investment development activities.

Eligibility

Benefits of DTDi

The examples below illustrate potential tax savings through DTDi when an eligible expense is not an Allowable Business Expense¹ under the Income Tax.

Case 1: Company A spent S$10,000 to participate in an overseas tradeshow to reach out to its buyers in Europe

| Without DTDi support | With DTDi support | |

| Revenue | S$100,000 | S$100,000 |

| DTDi eligible expense of S$10,000 | (S$10,000) | (S$20,000) |

| Other expenses | (S$20,000) | (S$20,000) |

| Taxable income | S$70,000 | S$60,000 |

| Tax payable (@ 17% as of YA2015) | S$11,900 | S$10,200 |

| Savings from DTDi | N.A. | $1,700 |

Case 2: Company B posts a staff into an overseas subsidiary to drive its marketing efforts in-market. Staff basic salary is $2,000 per month.

| Without DTDi support | With DTDi support | |

| Revenue | S$100,000 | S$100,000 |

| DTDi eligible expense of S$2,000 x 12 months | N.A. |

(S$48,000) |

| Other expenses | (S$20,000) | (S$20,000) |

| Taxable income | S$80,000 | S$32,000 |

| Tax payable (@ 17% as of YA2015) | S$13,600 | S$5,440 |

| Savings from DTDi | N.A. | $8,160 |

How to apply

- that do not fall under automatic DTDi

- with quantum exceeding the first S$150,000 for that year of assessment under automatic DTDi

Applications must be submitted before project commencement.

IRAS will assess if expenses submitted qualify for tax deductions.

View the detailed DTDi ESIMS Userguide here.

Need additional help?

Double Tax Deduction for Internationalisation