Overview

The Investment Chapter in a Free Trade Agreement (FTA) aims to make it easier for Singapore investors to invest in our FTA partners. This is achieved by lowering the barriers to entry for investors, providing a predictable operating environment through agreed standards of protection for investors, and offering investors an avenue for recourse if FTA obligations are breached.

- What is an Investment?

- Investment can take the form of tangible or intangible assets (e.g. land, factory, stocks shares)

- In Investment treaties, investments are seen as either pre-establishment or post-establishment.

- Pre-establishment: The act of attempting to make or making an investment (e.g. concrete action(s) was taken to make an investment, such as channelling resources or capital in order to set up a business, or applying for a permit or licence)

- Post-establishment: The state of an investment after an investor successfully invested in a market (e.g. a factory is completed, a stock is bought).

- How does an Investment Chapter work?

Investment Chapters aim to reduce and remove barriers and requirements to invest for certain sectors. It provides protection for existing investments, and may have investor-state dispute settlement mechanism (ISDS) for recourse. While most investment chapters cover both pre- and post-establishment investments, some only cover the latter. Not all FTAs have Investment chapters. - Bilateral Investment Treaties (BITs)

BITs are another type of trade agreement that only focuses on investment unlike bigger FTAs. It only covers post-establishment investments. Refer to MTI’s webpage for the list of BITs that Singapore has.

Components of an Investment Chapter

- Overview

An Investment Chapter consists of two components:- Investment Chapter

- Lays out commitments for parties in the FTA to follow

- Schedule of Commitments

- Annexes which list the economic sectors the Chapter commitments apply to

Note:- Not all sectors in an economy are open, i.e. there is no free market access for all sectors

- Please read the annexes for details on government regulations and level of liberalisation per sector

- Key Investment Chapter provisions

- Definitions & scope articles

- Includes criteria for an investment according to the FTA

- Expropriation Article

- Condition on when a trade partner can expropriate investments

- Treatment Articles

- Fair treatment for foreign investments and investors

- Transfers

- Commitment to allow transfer of investment-related capital except under certain circumstances

- Investor State Dispute Settlement (ISDS)

- Procedures if an investor wants to take a trade partner to arbitration (Note: Not all FTAs/BITs have ISDS)

- Exclusions & Exceptions

- To safeguard government’s interests e.g. on security & public health

- Schedule of commitments (where applicable)

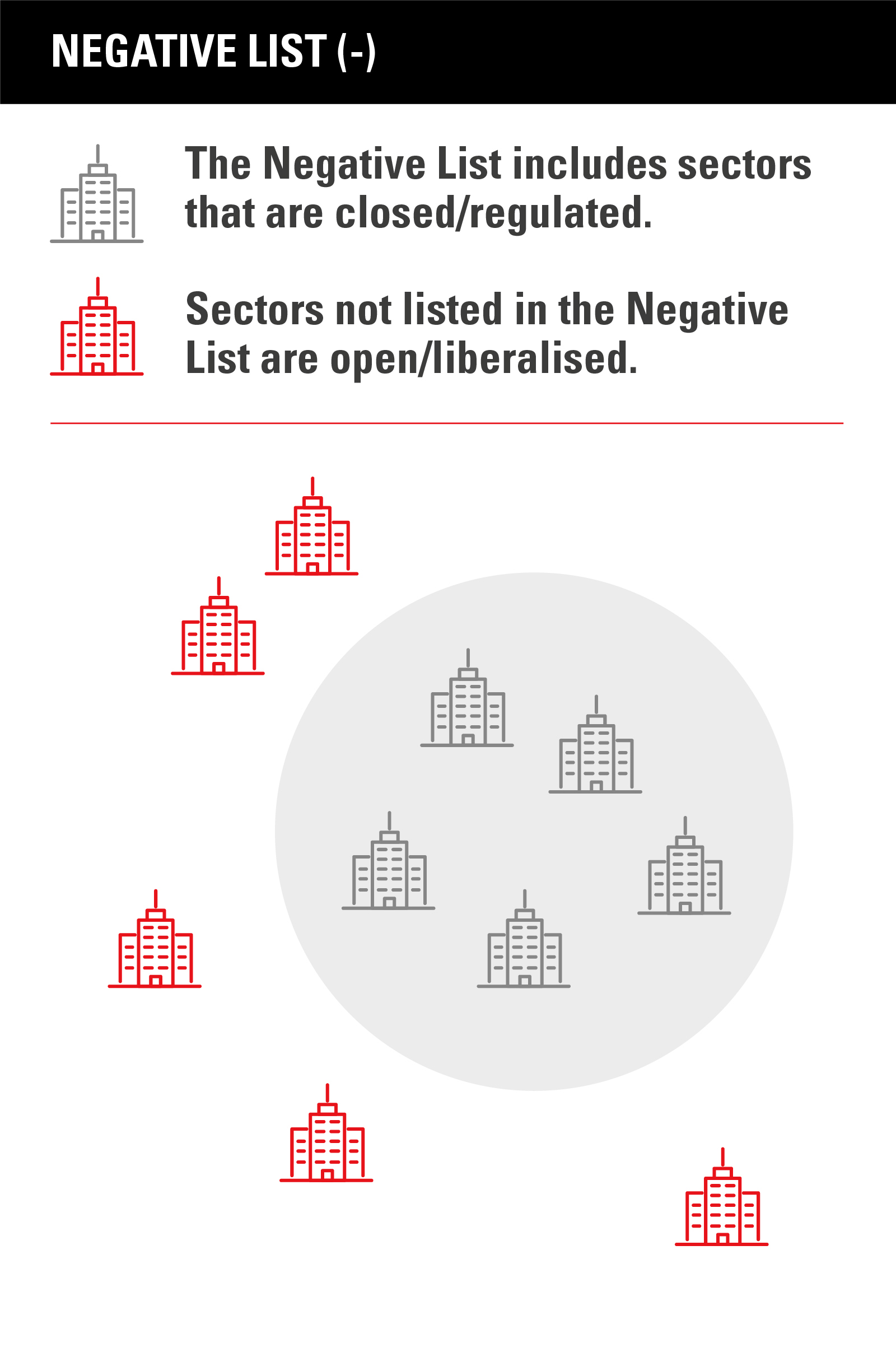

It is not practical to list down every type of investment that can be made in an economy due to the many types of investments. As such, when an FTA has market access commitments for Investment, it is typically done in the negative list.

Examples of the Investment Schedule Commitments (illustration purposes only)

Take note of description in Item 3 for investing into the market, and factor them into your business decisions when planning to enter a market.

Recourse

Dispute Settlement (where applicable)

Where applicable, some FTA Investment Chapters provide an avenue for investors to seek recourse against those who contravene their commitments via the Investor-State Dispute Settlement mechanism.

Investor-State Dispute Settlement (ISDS)

The ISDS mechanism provides a way for investors to submit their disputes for resolution via neutral international arbitration. This allows investor rights to be protected and fosters a political neutrality between countries signing the FTA.

Arbitration is not the only way - the ISDS Mechanism requires both parties to go through a period of consultation to try and reach an amicable settlement before going through with arbitration proceedings. It is recommended for investors to explore alternative dispute settlement resolution mechanisms such as mediation, conciliation, and good offices before considering arbitration.