Eligibility

-

What is the eligibility criteria for the MRA Grant?

- Business entity that is registered/incorporated in Singapore;

- At least 30% local shareholding;

- Company’s Group Annual Sales Turnover of not more than S$100 million, or Company’s Group Employment Size of not more than 200 workers; and

- New to target overseas market (at country-level)

-

What qualifies as a new overseas market?This is defined as a new overseas country that the company is expanding to, where its annual overseas sales in the country has not exceeded S$100,000 in any of the preceding three years.

-

Can a company with existing overseas presence or overseas sales apply for MRA support?

Companies that have previously benefited from MRA, but whose overseas sales in each of the preceding three calendar year for that target market did not exceed S$100,000, can continue to apply MRA during the enhancement period of 1 April 2020 to 31 March 2026.

-

Can a company apply to multiple new markets concurrently?

Yes, companies may apply for multiple new markets simultaneously. Approval will be based on demonstrating adequate financing and manpower resources to support multiple market expansion projects.

-

Can a non-profit organisation apply for MRA?

MRA only supports Singapore-registered business entities with key objective to generate overseas revenue/income. Applications from entities such as non-profit organisations, societies, religious entities, venture capital companies, investment holding companies or government subsidiaries, etc. will be rejected.

-

Can a company apply for MRA in addition to financial schemes from Enterprise Singapore or other government agencies?

Companies are not allowed to apply for the MRA support after they have received grant approvals from Enterprise Singapore or other agencies for the same eligible expenses or events.

-

Can a company apply for both the Enterprise Development Grant (EDG) and MRA support concurrently?Yes, companies may apply for support under both EDG and MRA, as long as it is not for the same scope of work/services/activities supported.

-

Can a company apply for Double Tax Deduction for Internationalisation (DTDi) on the same expenses supported by the MRA?Yes, companies can also benefit from the DTDi for the same expenses. Qualifying expenses for tax deduction will be computed net of the MRA grant.

-

Can a newly registered company apply for MRA?

Yes, newly registered companies with less than one year of operations may apply for MRA. Approval will be based on demonstrating adequate financing and manpower resources to support the market expansion project. To facilitate the assessment process, please upload updated certified management accounts from your date of incorporation.

-

When can a company commence with the project?

Companies can only sign contracts with third-party consultants or vendors after submitting their application. For BD staff employment, companies may extend job offers but can only finalise employment contracts after application submission. Project commencement and completion dates must align with the project support period stipulated in the BGP.

-

What does a retrospective application mean?

An application is deemed to be retrospective if any of the following events took place before application submission:

- Payment made to third-party consultant/vendor, including initial deposit

- Contractual agreements/purchase orders signed with the third-party consultant/vendor

- Employment contracts signed with BD staff

- Project commencement, including preliminary activities such as engaging third-party consultants, vendors, or BD staff to conduct market research

Applications for participation in overseas physical and virtual trade fairs are the only exception, as we recognise that a longer preparation time is required, and companies may need to secure the booth space in advance. Companies may make payment (including initial deposit) and/or sign the contractual agreement/rental agreement/purchase order with the show organiser/third-party vendor before application submission. However, applications should be submitted no earlier than 6 months before the trade fair’s official commencement date.

-

Can companies engage a related associate as the third-party consultant/vendor?

To ensure that there is no conflict of interest (COI), applicants should not have any relationship, connection, association, or dealings with their appointed third-party consultant/vendor, directly or indirectly via persons of authorities such as directors/shareholders.

The application will be rejected if there is COI detected between the applicant and their third-party consultant/vendor.

-

Can a company apply for a scope of work that it has internal capabilities to provide as a service to their clients?

No, MRA supports eligible third-party costs for activities and services that companies do not have the in-house or internal capabilities to carry out.

-

Under what other circumstances will applications be rejected?The following list is non-exhaustive:

- A company which does not meet the eligibility criteria

- A company holding a shell business registration or having its main business operations outside Singapore

- A company seeking support for the purpose of fundraising or increasing domestic sales

- A retrospective application

- False declarations

Supportable Activities

-

Can a company seek MRA support for LEAD-supported trade fairs under any of the following circumstances?

We strongly encourage companies to tap onto LEAD supported trade fairs to reach global customers, get feedback on products and services, and learn more about overseas markets. Please refer here for LEAD supported tradeshows.

MRA support will not be provided for LEAD-supported trade fairs, including in any of the circumstances:

- There is unavailable booth space under the Singapore National Pavilion supported under LEAD

- It can secure a better booth location compared to the Singapore National Pavilion

- It prefers not to be part of the Singapore National Pavilion for various reasons

- It prefers to exhibit at a different specialty hall within the same LEAD supported tradeshow

-

For physical trade fairs, why is the grant support for booth space capped at 36 square metres?

MRA support covers up to the standard booth size based on majority of applications. Based on overall trends, a booth space of 36 sqm is reasonable for companies across different industries (includes the display of machines, furniture, etc.)

-

Does a company need to follow any standard design for its booth at a physical trade fair?

No, but the applicant company’s name or brand should be clearly displayed on the booth and exhibitor listing. The brand may be represented by the applicant company (e.g., as an exclusive distributor) or owned by the applicant company through intellectual property rights.

Additionally, the overseas trade show should be an international trade fair where companies showcase their products and services primarily to trade visitors. These fairs must have international exhibitors and visitors.

-

Can a company apply for another Overseas Business Development (OBD) project in the same overseas market?

OBD projects should be at least 6 months to allow companies sufficient time to build relationships and networks in the market to be effective. For companies with a previously approved OBD project (e.g. business match/IMBD/OMP) applying for a new OBD application for the same market, approval will be subject to assessment. We encourage companies to first follow up on completed projects and explore opportunities in new markets for greater business expansion potential.

-

Can business matching projects be conducted virtually?

While virtual business matching meetings can serve as initial touchpoints to identify potential partners, business matching projects should primarily be conducted in-person as they are generally more effective. In-person meetings allow for direct participation from companies and customised one-to-one business meetings in the target markets. The intent is to support companies in finding suitable partners and generate new leads for quicker access to overseas markets.

-

Can companies apply for Overseas Marketing Presence support if they have not confirmed/hired the BD staff who will be posted into the target market?

Yes. In such cases, please submit the Job Description of the BD staff (in place of the Employment/Appointment Letter) for application evaluation. Please note that support for BD staff covers basic salary only, and the staff member must be stationed in the market throughout the project duration. Owners and shareholders of the applicant company are not supported under Overseas Marketing Presence.

Once the BD staff has been confirmed/hired, please update the application, or submit a Change Request in BGP with the Employment/Appointment Letter.

-

For Overseas Marketing Presence (OMP) support, does the Business Development (BD) staff need to be permanent staff of the applicant company?

No, the BD staff may be hired on full-time contracts and can be employed either by the Singapore applicant company or its subsidiaries, depending on overseas market requirements. For expenses incurred by overseas subsidiaries, documentation must clearly demonstrate the inter-billing of invoices to show that the Singapore applicant company ultimately bears the costs.

-

For Market Entry applications, would support be granted for the incorporation/registration of entities in the overseas market under individuals’ (e.g., company shareholder/director/employee etc.) names?No. To qualify for MRA support, the entity should be registered with the applicant company as the corporate shareholder unless local regulations prohibit corporate shareholding and supporting documentation is provided.

-

For Market Entry applications, would support be granted for import/export certifications for overseas markets?

Yes, the costs associated with obtaining registration costs for import/export certification purposes are supportable, such as FDA registration costs and factory registration costs.

-

For Market Entry applications, can a company seek support for IP search and registration across multiple overseas markets in one single application?

For international IP applications, companies can submit one single application for multiple overseas markets under the Madrid System, Patent Cooperation Treaty (PCT) System, Hague System, etc. Companies should indicate all the target markets covered under these international systems in the application form. Singapore IP registration costs are eligible for support when they form part of an international IP application process.

For direct national IP applications, companies should submit one MRA application for each overseas market. For more information, please refer to IPOS' website.

-

Can the IP registration support objection fees?

IP registration support can include prior art search, examination costs, objection costs, and filing costs etc. However, once the claim has been submitted and approved, objection costs will not be supported as a standalone cost.

-

Can the IP to be registered be owned by the license/franchisor?

For IP MRA applications, the trademark/logo/device/patent etc. must be owned by the grant applicant.

-

What expenses are not supported under MRA?

Please note that the lists below are not exhaustive:

For all activities:

- Singapore-imposed Goods and Services Tax (GST)

- Out-of-pocket expenses (e.g., airfare, accommodation, transport, staff meals)

Overseas Marketing and PR activity

- Publicity costs to raise capital or investments

Overseas Trade Fairs

- Co-sharing/co-location of booth by multiple exhibitors

- Publicity costs to raise capital or investments

- B2C fairs only

Business Matching and In-Market BD

- In-house manpower

- Concurrent OBD approved MRA fees in the same market (e.g. OMP and In market BD etc.)

Overseas Marketing Presence

- Incidental costs – BD staff’s salary paid in shares or equity, overtime pay, commission, bonus, additional allowances/incentives, airfare, meals, accommodation, insurance

- BD staff who are freelancers or working remotely

- Other office costs – Rental of warehouse, factory space, residential space, hotel room/suite, equipment/furniture, fixture, utilities, internet/ telecommunication costs, etc

Market Entry

- Standalone objection cost

Business Grants Portal and Corppass

-

What is the Business Grants Portal?The Business Grants Portal (BGP) is a one-stop portal for businesses to apply for government grants. This paperless system allows entities to find the grants they need with ease, enjoy a convenient form completion process, and reduce the time spent on the application.

If the company has yet to register for a Corppass Administrator account, please visit www.corppass.gov.sg. After successful registration, users need to be assigned the e-Service access to the BGP in order to submit their grant application.

-

Who should I contact for technical enquiries about the Business Grants Portal?

You may contact the BGP helpdesk at +65 6708 7288 or bgp_helpdesk@enterprisesg.gov.sg.

Operating hours are from 8:30 am to 5:30 pm (Mondays to Fridays).

-

Who should I contact if I have questions on Corppass Registration?

You may call the Corppass Helpdesk at +65 6643 0577 or email them at support@corppass.gov.sg.

Operating hours are from 8:00 am to 8:00 pm (Mondays to Fridays) and from 8:00 am to 2:00 pm (Saturdays). Closed on Sundays and Public Holidays.

-

My company is exempted from having our accounts audited. What documents should we upload under the BGP’s Company Profile?

You may choose to upload unaudited financial statements or certified management accounts, if audited statements are unavailable.

If the company is newly registered and a full year’s financial statements are not available, you may provide unaudited financial statements or certified management accounts for the year-to-date.

-

What happens if the personnel handling the company’s grant application leaves the company? Can another staff submit the application on his/her behalf?

Any personnel assigned as a BGP user in the company and given a Preparer or Acceptor role by the company’s Corppass Administrator can edit and submit the grant application. Contact details of the new user should be updated on BGP.

-

What happens if the CEO/MD who is authorised to accept the Letter of Offer (LOF) leaves the company? How does the applicant update the BGP and Corppass?

Under the e-Service section on BGP, the company’s Corppass Administrator should assign an Acceptor role to the new CEO/MD. This enables him/her to accept the LOF.

If the grant has not been approved, the Corppass Administrator can update the LOF addressee in the grant application form.

If the grant has been approved and the LOF has been issued, no amendment to the addressee can be made.

-

How can applicants change their Corppass roles to accept the Letter of Offer?

The applicant company’s Corppass Admin would need to add in the “MTI – Business Grants Portal (BGP)” digital service:

- Login at www.corppass.gov.sg

- Go to "e-Services" > "Select Entity e-Services"

- Type “bgp” in the search bar to the right (next to "filter")

- Tick the box on the left of “BGP”, then press "Next"

- If there is no checkbox to tick, you may skip ahead to Step 7 below.

- Press "Next" and "Submit"

- Press "Return to Homepage"

- After adding BGP for the company, the Admin would then need to assign it to the relevant staff.

- Go to "e-Services" > "Assign selected e-Services"

- Tick the box next to the relevant staff’s name and press "Next".

- Type “bgp” in the search bar to the right (next to "filter")

- Tick the box on the left of “BGP”, then press "Next"

- Select the “Acceptor” role.

- “Authorization Effective Date” can be today

- “Authorization Expiry Date” can be left blank

- Press "Next" and "Submit"

- If you are unsure of who your Admin is, you may use your SingPass to check on the identities of your entity’s Corppass Admins and Sub-Admins

- Go to www.corppass.gov.sg

- Click on "Services" > "Find Your Corppass Admin"

- Login to SingPass

- Enter the company’s UEN

- Press "Search" (the respective admins’ names will be displayed)

For further enquiries regarding Corppass roles, please refer to the Corppass User Guide.

-

Can a company request other parties such as vendors/service providers/corporate secretaries or any other third party to submit the MRA applications, change requests, claims, on their behalf?

All submissions in the portal must be made by the Grant Applicant/Company through its authorised employees/staff (i.e. users). Submissions must not be made by vendors, service providers, or any other third party, on behalf of the Company.

Change Requests

-

What if a company cannot complete the project within approved qualifying period (QP) or submit the claims within the stipulated deadline?

The maximum support period for MRA is 12 months, and companies have a maximum of 3 months to submit its claims upon completion of the project. Companies with valid reasons may request for an extension from Enterprise Singapore via BGP before the project end date by submitting Change Request. The request will be subject to approval.

For projects with prolonged delay, especially those that have not commenced or have barely started, companies should consider terminating the current application and submitting a fresh application when they are ready to proceed.

-

What if a company wants to change the consultant/vendor (i.e., obtain new quotation/proposal) after application has been approved?

If payment has not been made and project has not commenced, companies should submit a new application on BGP for assessment and cancel the existing approved project.

If project is ongoing, companies should submit a change request on BGP under “Change in project costs” for assessment, including a quote from the new vendor before the project end date. The change request will be subject to approval.

Claims

-

Why are there queries from Enterprise Singapore after the auditor has approved my claims?

The auditor’s responsibility is to verify and confirm costs incurred in accordance with the provisions of the Letter of Offer (LOF). The Auditor’s Report and Statement of Claim will be issued upon completion of verification of Qualifying Costs. Enterprise Singapore will separately review the project deliverables as stated in the LOF and will reach out if there are queries.

The guide on submission of claims can be found here.

-

When do companies need to submt claims?

Claims must reach Enterprise Singapore no later than 3 months from the end of the project qualifying period, failing which Enterprise Singapore reserves the right to refuse payment. Please note that completeness of submissions would help to ensure efficient processing of the claims.

-

What are the contact details of Enterprise Singapore-appointed auditors?Upon approval of the MRA grant, please refer to Annex 6 of the Letter of Offer in the Business Grants Portal.

-

Is inter-billing and/or cost sharing between related companies of the applicant company allowed?

As all payments should be incurred and paid for by applicant, during audit, auditors will verify supportable costs based on the principle that there are sufficient supporting documents to show that all payments had been duly made as required.

If the applicant does not incur expenses directly but assigns its overseas entity to execute and pay for the expenses, inter-billing can be used to transfer expenses back to the Singapore applicant.

-

Can a company claim for additional expenses which would only be billed by the third-party consultant/vendor after the activity is completed?

MRA accepts only a single and final claim. All qualifying costs will be based on the quotation submitted during application stage. The approved quantum is final, and additional claims are not allowed.

-

Can the MRA grant be provided on a cash advancement basis?No. The MRA grant is administered on a reimbursement basis to ensure that the grants are strictly utilized for the approved project.

-

How will I be notified of the claims disbursement?An email will be sent to the email address stated in the Business Grants Portal to confirm the transaction.

Withdrawal of Grants

-

Steps

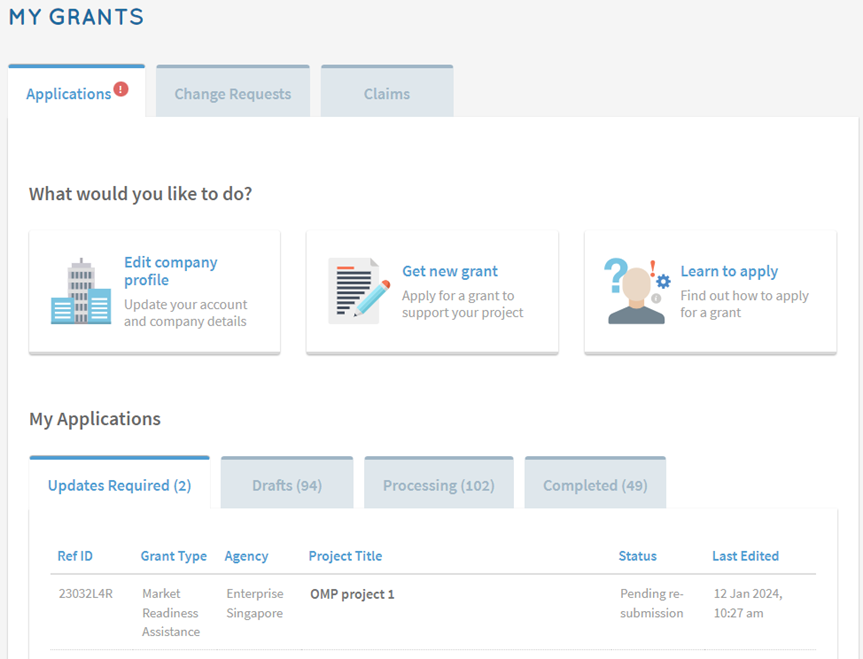

Step 1/4

- Acceptor login to BGP > Click on "Updates Required" tab

- Click on grant's Project Title/MRA Ref ID

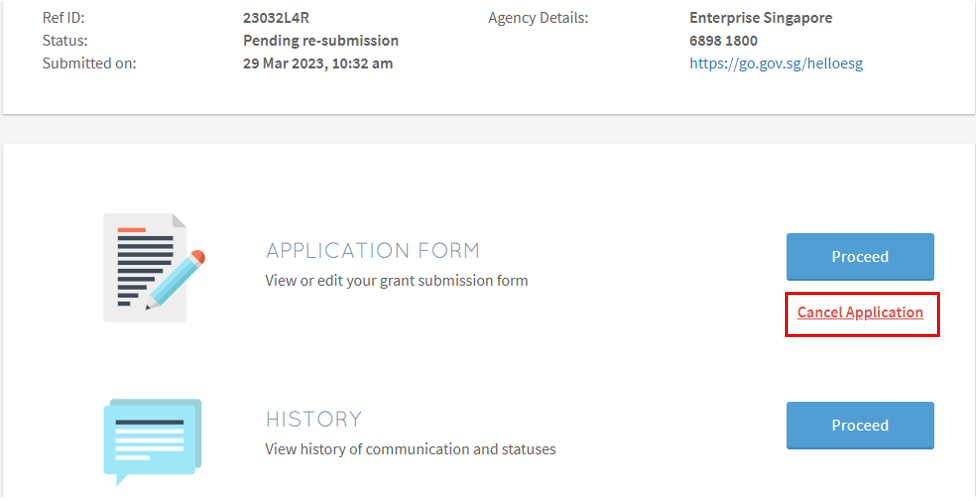

Step 2/4

- Click on "Cancel Application"

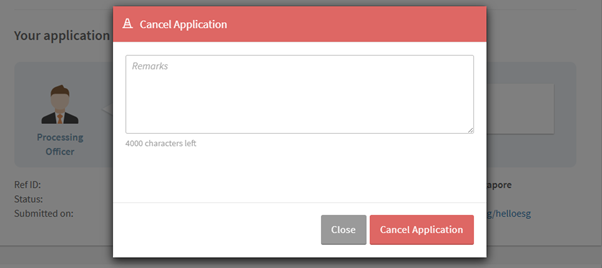

Step 3/4

- Enter details in Remarks section

- Click on "Cancel Application"

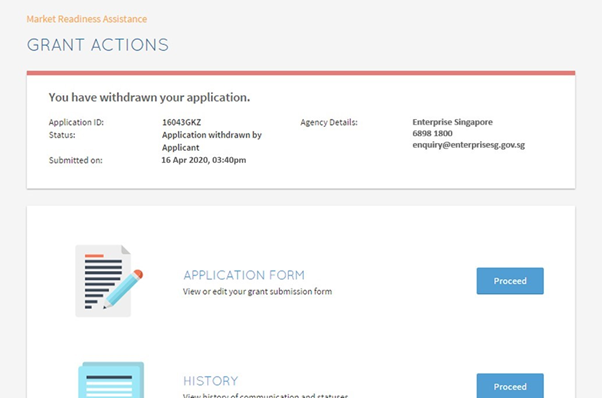

Step 4/4

- Grant application has been withdrawn

Helpdesk Contact

-

Enterprise Infoline

For further enquiries, kindly contact us through the Enterprise Infoline.

-

SME Centres

If you are unsure which initiatives and programmes you should tap on, and would like to get in touch with business advisors from SME Centres for advice, please make an appointment here for a call or Skype chat. Walk-ins are allowed during operating hours, but SMEs are strongly encouraged to make an appointment to confirm the slot.

The operating hours are from 9am to 5:30pm (Monday to Friday).